Dark Web Scans

Should you do a dark web scan for your business or personal information? Many of companies promote dark web scans online or on TV. For instance, Experian offers a free scan when you set up an account with them.1

Supposedly, dark web scans discover whether or not someone hacked your personal and financial information. Often, you’ll find this info on the “hidden” web where criminals try to sell it.

In this article, we explore whether or not you should do a dark web scan.

What is the Dark Web?

Besides the Surface web which everyone explores, there exists a hidden web with sites called the “Deep Web.”

The Dark Web refers to the part of the Deep Web where criminals have illegal sites and conduct illegal activities, like selling stolen Social Security numbers or drugs. Also, you need special software, like one called Tor, to access this web.

Dark Web Scans: Are They Worth it?

To answer this question, we’ll compare the regular web with the Deep web. The regular web, which we can see, is really small compared to the Deep web. It can thought of as the surface of the ocean, while the Deep web constitutes the rest.

Also, you can search the Surface web using search engines like Google, Bing or DuckDuckGo. On the other hand, one cannot search the Deep Web.2

Because of its large size and unsearchable neature, we don’t recommend doing a Dark web scan. It’s like looking for a needle in a hay stack. Also, criminals use a lot of tools on the Dark web to hide their identity. Until they thoroughly screen other parties and collect payment, they do not make sensitive personal and financial information available .3

Nothing is Free!

Therefore, we suggest that you don’t try any of the free dark scans the Experian Credit Agency and others offer. They advertise free scans to try to get users to sign up for their paid monthly services.

Experian offers a free dark web scan to see if someone hacked your email address and password. We believe they don’t do a real dark web scan, but just looking at publicly available data dumps. If you sign up for their monthly plan, Experian offers to do a search based on your Social Security number, bank account numbers and other information. Therefore, Experian uses the initial free scan to entice you to sign up for their monthly subscription service.4

How Can I Tell if my Info has Been Hacked?

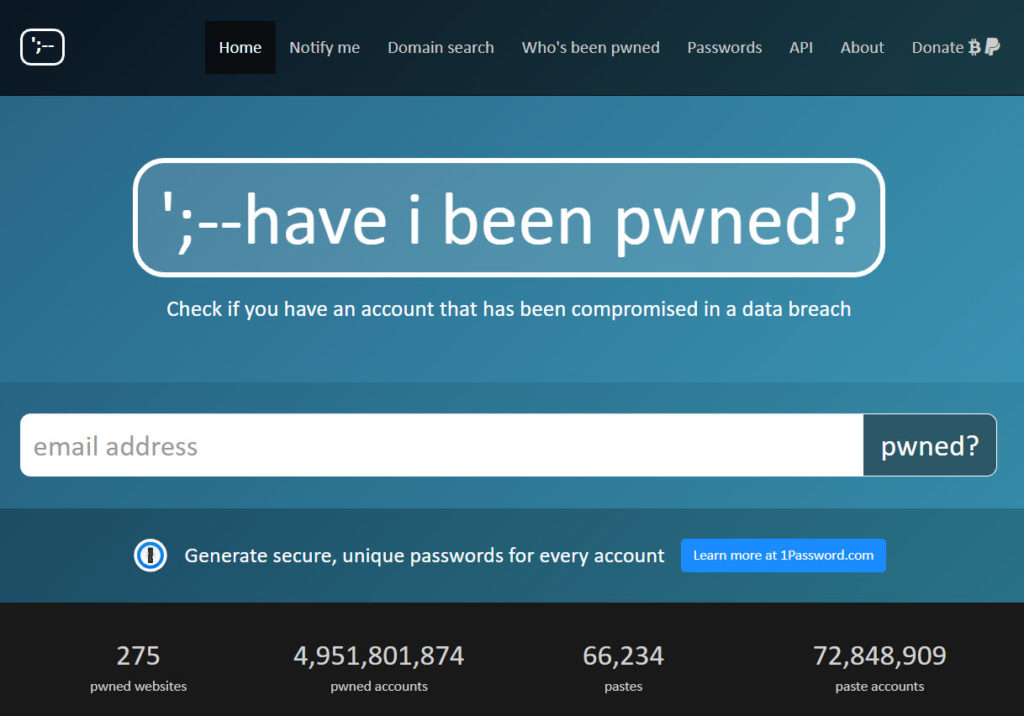

Instead of requesting a dark web scan, you can use some free tools to see if your sensitive information has been exposed. For instance, at one website (https://haveibeenpwned.com/), you can check if someone hacked your info. Also, you can set up an account to receive alerts in case someone hacks one of your accounts.

Also, BreachAlarm represents a good alternative to the “Have I been Pawned” website and offers many of the same services and features. A website called DeHashed differs some from these other two. Besides checking on email address hackings, DeHashed searches for hacks related to your name, password and other info.5

How Can I Protect Myself and My Business?

You should operate under the assumption that a hacker compromised your login credentials at some point. Last year, cybercriminals hacked the Equifax credit agency and got Social Security and Driver’s License numbers on over 143 million people.6

To protect yourself and your business, you should use unique passwords for every online account and also change these passwords frequently (at least once every three months). By using a password manager like Lastpass or Dashlane, you can secure online accounts.7

To protect yourself further, you should consider putting a freeze on your credit with the three main credit bureaus (i.e., Equifax, Experian and TransUnion). This will prevent any criminal from requesting credit using your stolen info. If you need to request credit, like applying for a home loan, you can temporarily unfreeze your credit.8

Freezing you credit will not prevent your bank or other financial accounts from being hacked. You will should monitor their activity separately.

References:

1 Experian.com “Is Your Information on the Dark Web?” Link to Site

2 Dailydot.com “A beginner’s guide to the dark web” Link to Site

3 Howtogeek.com “What is a “Dark Web Scan” and Should You Use One?” Link to Site

4 Makeuseof.com “The Experian Dark Web Scan: Do You Need it and Can You Trust it?” Link to Site

5 Digitaltrends.com “How to know if you’ve been hacked” Link to Site

6 Fortune.com “Equifax Hackers Steal Personal Details of Up to 143 Million People” Link to Site

7 Malwarebytes.com “10 ways to protect against hackers” Link to Site

8 Consumer.ftc.gov “Credit Freeze FAQs” Link to Site

Credit Agencies:

Equifax: Link to Website

Experian: Link to Website

TransUnion: Link to Website